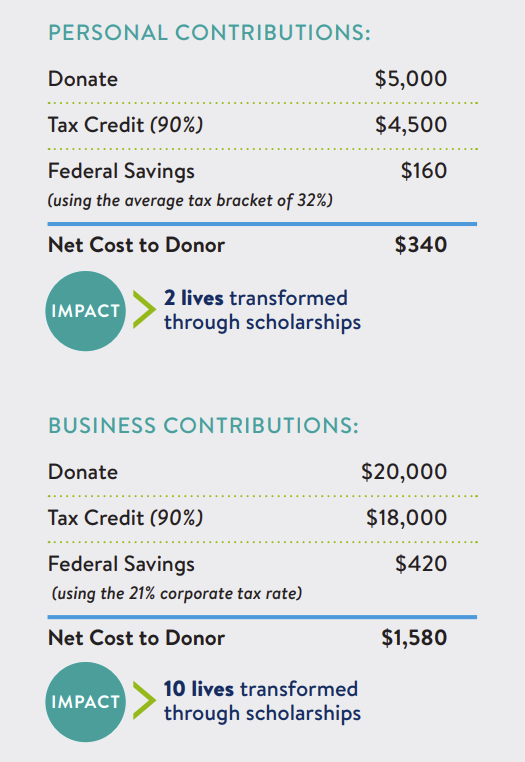

The Pennsylvania educational tax credit programs (EITC/OSTC) incentivize donors to transform their tax dollars into scholarships for kids who are eager to learn at safe, quality tuition-based schools. Businesses and individuals can receive 90% (dollar-for-dollar) PA tax credits for their donations, along with the opportunity for a small federal deduction.

WHO IS ELIGIBLE:

- S-Corp, sole proprietorship, LLC, LLP, or C-Corp authorized to do business in PA

- Owners or shares in a corporation that conducts business in PA

- Individuals or households with a PA tax liability (CSFP suggested minimum is $2,500)

CSFP MAKES IT EASY FOR YOU!

- Determine your annual tax liability

- Sign a membership agreement

- Make a contribution

- CSFP does the rest!

Fill out the form below to contact us today!